The ongoing coronavirus pandemic presents us all with unprecedented social and economic challenges. Between lockdown, incidence statistics, a European vaccine disaster, the surge in the stock market and simultaneous decline in the bond market, the specter of inflation has now also taken hold. The topic is being controversially discussed in the current economic situation. No wonder, as there are few historical experiences to fall back on for this economic (crisis) scenario. In a normal growth phase, inflation can arise from a faster increase in wages compared to the increase in production. The central banks then try to limit inflation with restrictive monetary policy and prevent an upward wage-price spiral. So far, the theory. However, the pandemic has set central axioms of the causal relationships aside. The crisis is particularly characterized by the fact that a part of production was paralyzed almost overnight in a fundamentally healthy economy and the demand for many goods suddenly declined. Due to the external shock, lower demand met with a smaller supply, which had the advantage that prices remained largely stable despite the completely different economic performance. In fact, after the outbreak of the pandemic, the rate of inflation remained relatively low, even deflationary, for a long time. The output gap, which emerged overnight, is unparalleled in history. After more than a year and a half of crisis, the extent of the supply gap between production potential and actual production remains uncertain. How quickly and whether unused production capacities can be ramped up in a recovering economy can only be guessed at. Inflation forecasts are also made more difficult by the fact that the economic shock affects the world economy simultaneously. However, the recovery shows large regional differences due to divergent pandemic management.

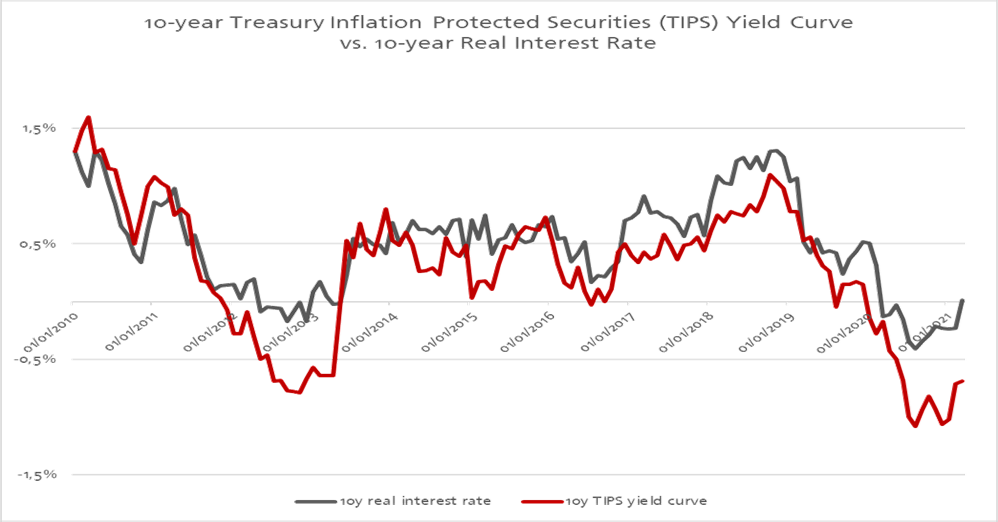

The US indicator TIPS (10-year Treasury Inflation Protected Securities, see red line in graph) reveals that the markets are actually expecting rising inflation. The expansion of the spread between the American 10-year TIPS and the 10-year bond yields clearly shows the increasing willingness of market participants to pay a higher premium for inflation protection. This development began immediately after the outbreak of the pandemic and remains at a very high level today. It is a proven fact that high and rapidly rising inflation expectations lead to a real increase in inflation in the following years. They act like self-fulfilling prophecies, especially if the central banks do not react early with restrictive monetary policy to rising expectations. However, the currency guardians are faced with the dilemma of having to balance the trade-off between stimulating the economy and keeping inflation under control. This is especially challenging given the uncertainties about the magnitude and duration of the pandemic and its economic effects. In view of the above, it is likely that the central banks will remain accommodative for a longer period of time and that the general environment for investments will continue to be marked by low interest rates, a high degree of volatility, and increased uncertainty.

In summary, the discussion about inflation reveals the challenges and uncertainties that the world economy currently faces. It is important to be prepared for a wide range of scenarios and to take a long-term perspective in investment decisions.