At the latest since the hastily enforcement of the Offenlegungsverordnung (EU Regulation), the topic of sustainable investment has become part of asset manager’s everyday life. No lecture, no webinar or newsletter, not even the FAZ can avoid highlighting at least one ESG aspect every day. Today, investors have a wide range of products for sustainable capital investment at their disposal. In these, the topic of climate protection, or the reduction of CO2 emissions, not only overshadows other sustainability criteria in the “S” (Social) and “G” (Governance) areas, but also other “E” (Environmental) aspects.

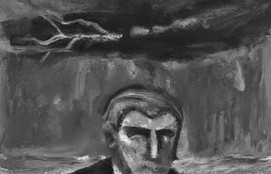

Fear of climate change and its potentially drastic consequences has now reached all sections of the population and increased the social pressure on everyone to take responsibility and help protect the climate.

The Intergovernmental Panel on Climate Change (IPCC), founded by the UN, plays a crucial but dazzling role in this development. The IPCC consolidates scientific work on man-made climate change and thus sets the agenda for world climate summits. The selection of scientific contributions follows political interests, so that one cannot speak of neutral reports. For example, it came to light that some of the scientific work was commissioned or financially supported by the IPCC itself, or that the results were predetermined. Research results that are not in line with the political interests of the IPCC are ignored, the work is often discredited and the authors are sometimes even defamed. In this way, the theory that humans are the sole cause of climate change is dogmatized.

In fact, although a correlation between the CO2 concentration in the atmosphere and the temperature measurements of the last 100 years or so can be identified, a causal, physical relationship between CO2 emissions, the greenhouse effect and global warming has neither been explained nor proven scientifically to date.

The basic assumption that human CO2 emissions are the only cause of climate change is therefore built on sandy ground. In addition, the CO2 emissions of humans of about 40 billion tons p.a. are offset by natural CO2 emissions of the earth of between 700-800 billion tons annually. This means that the CO2 emitted by nature not only exceeds the current total amount of CO2 emitted by humans by a factor of almost twenty, but also that the annual fluctuation of natural emissions alone is greater.

The Earth has mechanisms for counteracting natural fluctuations in order to stabilize them. In particular, the oceans absorb or release CO2 depending on temperature, so that a balance is created between the CO2 bound in the ocean and that in the atmosphere. The intensity of cloud formation by means of the water vapor contained in the atmosphere is also temperature-dependent and has a stabilizing effect.

The idea that in a few centuries we humans could overturn something that has survived 550 million years in the youngest earth age Phanerozoic alone seems like the modern version of the geocentric view of the world.

Thus, it is more likely to be political goals that make the Intergovernmental Panel on Climate Change adhere to the theory of man-made climate change. These, in turn, become clearer when looking into the future of the year 2030: According to the Paris Climate Agreement, all companies worldwide will then have to present corresponding emission certificates for their CO2 emissions. Countries will issue certificates to domestic companies for the amount of CO2 emissions that will then still be permitted. Since it is foreseeable that it will not be possible to achieve the necessary emission reductions by 2030, companies will in future be able to acquire additional emission certificates via a global trading platform. The operator of this platform is the Intergovernmental Panel on Climate Change or the UN. The commissions alone for the certificates traded on the platform are estimated to be around USD 250 billion.

But if we think it through to the end, it’s about more than just money.

Pricing CO2 emissions on the basis of (inter)governmental targets, quotas and regulations will enable governments to control and steer economic activities. The path thus mapped out towards central planning runs counter to all the basic principles of a free society. It subtly but massively attacks the open society as such.

But back to capital investment: it is especially the institutional investors who have the financial means and the human resources to develop their own sustainable capital investment strategy outside of today’s ecologically dominated standard. In this way, they not only reduce economic misallocations of capital, but also prevent concentration risk in their own portfolio caused by an overweighting of climate protection. It is therefore to be hoped that institutional investors will become aware of their great – also social – responsibility.