The events that have recently taken place in the stock market have been referred to using various metaphors such as David vs. Goliath, Empire vs. Death Star, or Robin Hood vs. King John. These refer to private investors who, via the Reddit community “WallStreetBets”, organized themselves to purchase shares, especially of GameStop (GME), causing a short squeeze of the invested short sellers. Several well-known hedge funds suffered losses ranging from 10-30% and had to turn to support from the industry and lobbying with brokers to prevent larger damages.

It is now evident that the mobilization of investors was by no means accidental. A handful of experienced and familiar protagonists with the rules of Wall Street carefully selected the companies involved, knowing the engagement of the respective hedge funds, and brought not only insider knowledge to the community but also concrete recommendations around the trading of the proposed positions.

Short-term speculative goals were likely not a central factor driving the actions of most investors. Instead, the community was driven by the prospect of giving the Wall Street establishment a collective slap on the wrist. As for the initiators, their motives may lie somewhere between personal grudges and political ideology. Therefore, it does not surprise us that the demonstration of power with 6 million mobilized private investors disregarded the unwritten law of Wall Street, not to attack any competitors, despite clearly good industry knowledge.

Did the initiators only aim to bring some hedge funds to the brink of insolvency? According to the latest entries in the Reddit community, this goal was not achieved.

Looking at the Short Interest/Float Ratio, we believe we can see a larger scenario. At the end of December 2020, this stood at 260%, before giving way during January, but still stood at 140% on January 28th, 2021. The normalization only began when private investors were cut off from trading by their brokers on Friday, January 29th, 2021. As a result, the Short Interest/Float Ratio fell to 113% on the same day and is now around 40%.

The short interest/float ratio shows the number of shorted shares compared to the total number of shares in the free float. Generally, a ratio of 35-40% or higher is considered extremely high and potentially dangerous for the company. In exceptional cases, this ratio can be over 100%. This happens, for example, when a market participant buys shares borrowed from a short seller, and the broker of that market participant then loans the purchased share to another short seller. This can explain short interest/float ratios of 113% or 140%, but not one of 260% as was the case with GameStop at the end of 2020. With a free float of about 50 million for GME, 130 million shares were shorted in January. At this magnitude, it is almost impossible not to suspect that a significant part of the short sales are counterfeiting or illegal naked shorts.

The idea of naked shorts is simple: the short seller sells shares that he could not (or did not want to) borrow. This creates counterfeit shares, i.e. shares that previously did not exist in the market. From a criminal law perspective, this corresponds to the offense of bringing counterfeit money into circulation.

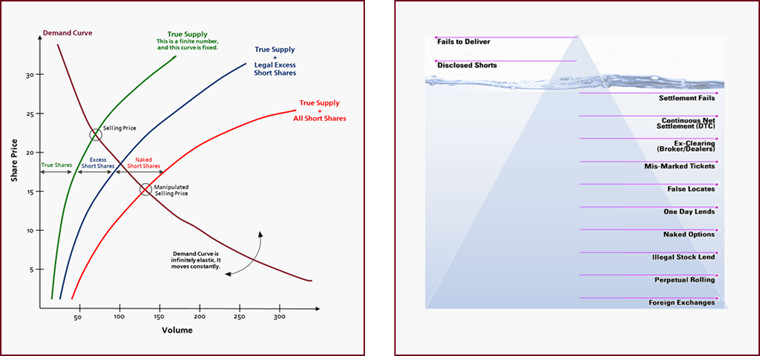

Although naked shorts on Wall Street and in Europe are strictly regulated by the SEC and ESMA, it is an open secret that the practice continues to be widespread. The supervision mainly focuses on the Fail-to-Deliver indicator reported by the exchanges, which shows the number of shares for which a trade has taken place but the stock package could not be settled afterwards. This is a characteristic sign of counterfeiting. For example, the Nasdaq reports 100 million shares daily as Fail-to-Deliver. This is only the tip of the iceberg: there are various ways and strategies for short sellers, brokers, and the central clearing house to create the conditions for naked shorts and delay the need to report Fail-to-Deliver events (see illustration to the right).

Counterfeit shares always increase the number of tradable securities in the market. The advantages for the short seller are obvious. The massively increased supply of counterfeit shares manipulates the market price during the sales transaction and also leads to a sustained dilution of the company’s value (see the figure above left). The risk of exposure of illegal activities is low for those involved due to the technical and systemic possibilities for obscuring such transactions.

The problem for the entire system arises when a high proportion of naked shorts occurs and short sellers are forced to cover their positions. The leverage effect then works in the opposite direction and turns against those with naked shorts. As a result of the inevitable escalating fail-to-deliver events, not only the extent of illegal practices is revealed, but also which players are involved.

Did the initiators of the mobilization of the private investor community possibly aim to enforce this transparency? If systematic illegal transactions by an interwoven network are confirmed, the consequences could trigger seismic waves through the international financial system.

This would also explain the panicked reaction of the establishment to recent events. Several large hedge funds rushed to provide liquidity to the distressed company in an unusual way. The forced trading halt of the affected securities for private investors by brokers, allowed short sellers to cover their positions at the last moment due to the 40% drop in demand caused by the abrupt halt. If the action actually missed the true goals of the initiators and the swarm, new “attacks” are likely not to wait for long. In the end, a showdown in the spirit of David versus Goliath, Empire versus Death Star, or Robin Hood versus King John may take place. The losses on all sides will not be small, that much is already certain.